Scammers are always a step ahead in finding new ways to deceive people. While security agencies crack down on one scam, fraudsters come up with another, keeping authorities on their toes. Though police and cybersecurity agencies frequently issue alerts, scammers continue to devise innovative tricks.

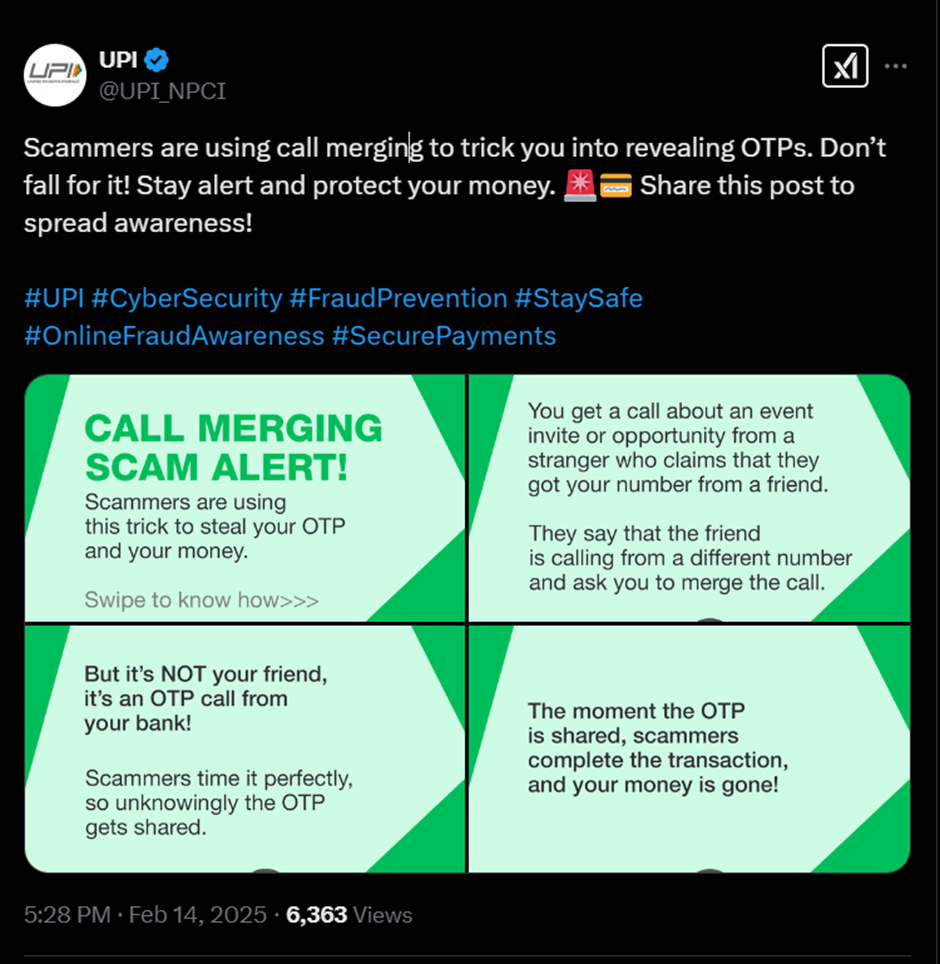

A new scam has surfaced, leaving no room for suspicion and making people easy victims. This latest fraud has even alarmed the National Payments Corporation of India (NPCI), prompting them to issue a warning on X. The NPCI has not only warned users but also shared tips on how to stay safe.

If you use UPI or online banking, it’s crucial to be aware of this ‘Call Merge Scam.’ In this method, fraudsters trick users into merging calls, enabling them to obtain OTPs without the user realizing it. Once they have the OTP, draining bank accounts is just a matter of seconds.

How This Scam Works

- You receive a call from an unknown number. The caller claims to have gotten your number from a mutual friend.

- They assert that they are already speaking with someone you know and request that you merge the call.

- At that moment, another call comes in on your phone. As soon as you merge the calls, your line connects to a bank’s OTP verification call.

- The fraudsters then intercept the OTP, gaining access to your bank account and steal your money.

According to Delhi Police’s cybercrime unit, OTPs for digital payments are sent via SMS or automated phone calls. Scammers exploit this by choosing the call-based OTP option while making transactions. They then trick users into merging calls, allowing them to hear the OTP and complete fraudulent transactions.

Fraudsters often pose as recruiters or event organizers, claiming to have received your number from a friend. They ask you to merge a call to verify details, but in reality, there is no friend on the other end—just their scam network.

How to Stay Safe

UPI has outlined several precautionary measures to protect users from fraud, such as:

- Ignore calls and messages from unknown numbers.

- Enable spam detection features on Android smartphones.

- Verify the caller before merging any calls.

- Banks never ask for OTPs—stay alert if anyone requests one.

- If you receive an OTP without any transaction, immediately contact your bank’s customer care or dial 1930.

- Keep UPI and banking security features enabled.

Staying informed and cautious is the best way to protect yourself from such scams. Always be skeptical of unexpected calls and never share sensitive banking details with anyone.